titlesuitsai

Tiểu thương mới

- Tham gia

- 8 Tháng tư 2024

- Bài viết

- 29

- Điểm tương tác

- 0

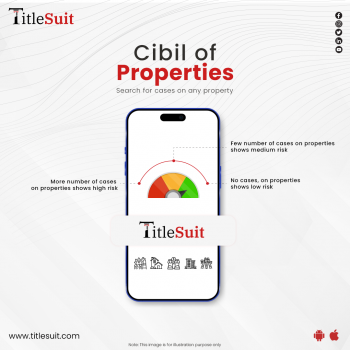

When it comes to property transactions, your creditworthiness plays a crucial role. One important aspect of your creditworthiness is your CIBIL score, which reflects your credit history and financial reliability. In this blog post, we will explore the significance of the CIBIL score in property -related matters and its impact on your financial journey.

1. What is a CIBIL Score ?

A CIBIL score is a three-digit number that represents your creditworthiness based on your credit history. It is provided by Credit Information Bureau (India) Limited (CIBIL) and is widely used by financial institutions when evaluating loan applications, including those for property purchases. A higher CIBIL score indicates a lower credit risk, making it easier to secure favorable loan terms and interest rates.

2. Importance of CIBIL Score in Property Transactions

When you apply for a property loan or mortgage, lenders rely on your CIBIL score to assess your creditworthiness. A high CIBIL score of 700-900 increases your chances of loan approval and allows you to negotiate better terms. On the other hand, a low CIBIL score may result in loan rejection or unfavorable loan terms. Maintaining a healthy CIBIL score is crucial for a smooth and successful property transaction.

Know more here about Cibil Of Properties

1. What is a CIBIL Score ?

A CIBIL score is a three-digit number that represents your creditworthiness based on your credit history. It is provided by Credit Information Bureau (India) Limited (CIBIL) and is widely used by financial institutions when evaluating loan applications, including those for property purchases. A higher CIBIL score indicates a lower credit risk, making it easier to secure favorable loan terms and interest rates.

2. Importance of CIBIL Score in Property Transactions

When you apply for a property loan or mortgage, lenders rely on your CIBIL score to assess your creditworthiness. A high CIBIL score of 700-900 increases your chances of loan approval and allows you to negotiate better terms. On the other hand, a low CIBIL score may result in loan rejection or unfavorable loan terms. Maintaining a healthy CIBIL score is crucial for a smooth and successful property transaction.

Know more here about Cibil Of Properties

Đính kèm

Relate Threads